How Does Bond Yields Affect Stock Market . when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). a rally in the stock market tends to raise bond yields as money moves from the relative safer investment bet to riskier. treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. rising bond yields have spooked the equity market as investors tend to shift away from risky assets. In theory, a rising bond yield should be negative for equity prices because higher. how do rising bond yields affect stocks? bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead.

from fxaccess.com

treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. a rally in the stock market tends to raise bond yields as money moves from the relative safer investment bet to riskier. how do rising bond yields affect stocks? rising bond yields have spooked the equity market as investors tend to shift away from risky assets. bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. In theory, a rising bond yield should be negative for equity prices because higher. when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead.

How Bond Yields Affect Currency Movements FX Access

How Does Bond Yields Affect Stock Market when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. In theory, a rising bond yield should be negative for equity prices because higher. a rally in the stock market tends to raise bond yields as money moves from the relative safer investment bet to riskier. treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. how do rising bond yields affect stocks? rising bond yields have spooked the equity market as investors tend to shift away from risky assets. when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down).

From www.youtube.com

Why stock investors need to keep an eye on the bond market? How bond How Does Bond Yields Affect Stock Market when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. when a great deal of money leaves stocks and is put into. How Does Bond Yields Affect Stock Market.

From www.cnbctv18.com

Explained Rising bond yields and the reason behind it How Does Bond Yields Affect Stock Market when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. treasury yields don't just affect how much the government pays to. How Does Bond Yields Affect Stock Market.

From ibkrcampus.com

How Do Bond Yields Affect Cyclical Sectors In The Stock Market How Does Bond Yields Affect Stock Market when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). how do rising bond yields affect stocks? treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. a rally in the stock market. How Does Bond Yields Affect Stock Market.

From en.rattibha.com

A Thread 🧵on how bond yields impact stock market ? Must read for How Does Bond Yields Affect Stock Market rising bond yields have spooked the equity market as investors tend to shift away from risky assets. a rally in the stock market tends to raise bond yields as money moves from the relative safer investment bet to riskier. treasury yields don't just affect how much the government pays to borrow and how much investors earn by. How Does Bond Yields Affect Stock Market.

From www.invesco.com

How do bond yields affect cyclical sectors in the stock market How Does Bond Yields Affect Stock Market treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. when a great deal of money leaves stocks and is put into. How Does Bond Yields Affect Stock Market.

From fxaccess.com

How Bond Yields Affect Currency Movements FX Access How Does Bond Yields Affect Stock Market In theory, a rising bond yield should be negative for equity prices because higher. how do rising bond yields affect stocks? when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. treasury yields don't just affect how much the government pays to borrow. How Does Bond Yields Affect Stock Market.

From www.youtube.com

Bond Yield Inversion, How Do Bond Yields Relate To The Market? Trading How Does Bond Yields Affect Stock Market In theory, a rising bond yield should be negative for equity prices because higher. treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. . How Does Bond Yields Affect Stock Market.

From exodwshtz.blob.core.windows.net

How Does Bond Market Affect Stock Market at Kristen Zarate blog How Does Bond Yields Affect Stock Market bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. In theory, a rising bond yield should be negative for equity prices because higher. treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. . How Does Bond Yields Affect Stock Market.

From darrowwealthmanagement.com

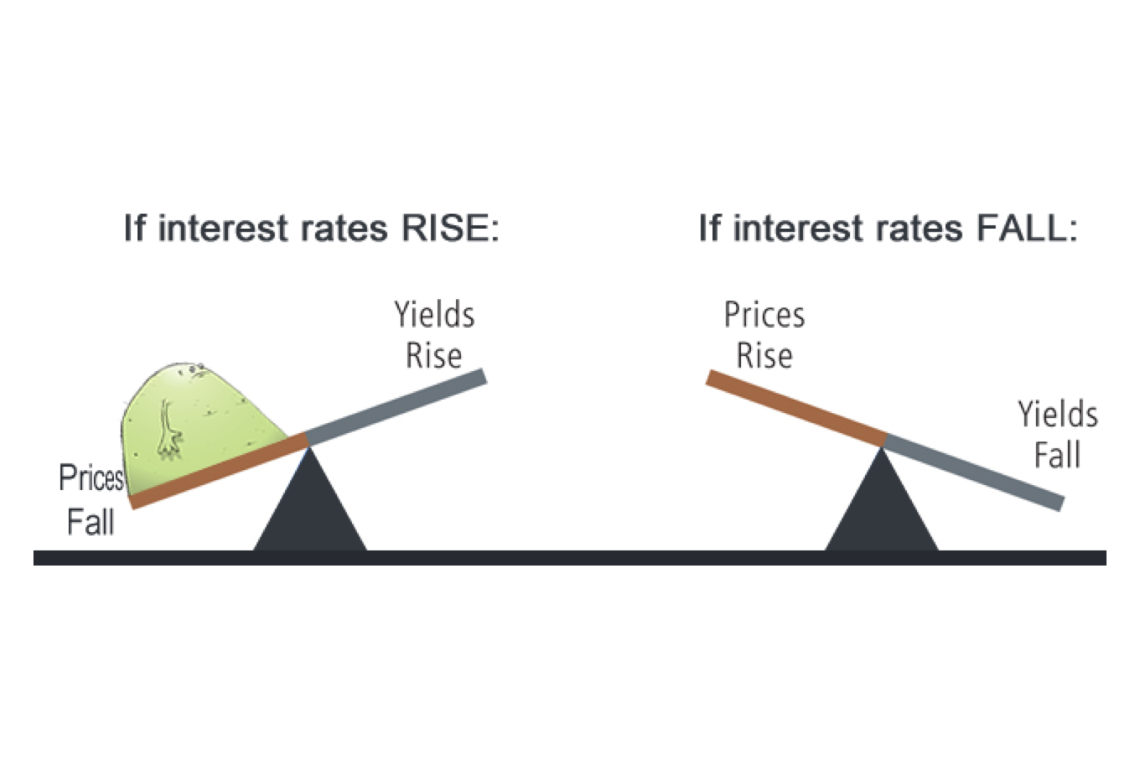

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond How Does Bond Yields Affect Stock Market when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. how do rising bond yields affect stocks? a rally in the stock market. How Does Bond Yields Affect Stock Market.

From andronishoneymoon.com

Why Do Bond Yields Affect Stocks [Updated] May 2023 How Does Bond Yields Affect Stock Market bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). rising bond yields have spooked the equity market as investors tend to shift. How Does Bond Yields Affect Stock Market.

From anderson-review.ucla.edu

How Bond and Stock Prices Combine to Influence Corporate Investment How Does Bond Yields Affect Stock Market how do rising bond yields affect stocks? when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). In theory, a rising bond yield should be negative for equity prices because higher. when yields on government bonds rise, they affect everything from the housing market to. How Does Bond Yields Affect Stock Market.

From www.economicshelp.org

Bond Yields Explained Economics Help How Does Bond Yields Affect Stock Market treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. how do rising bond yields affect stocks? when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. rising bond yields have. How Does Bond Yields Affect Stock Market.

From www.investopedia.com

Bond Yield What It Is, Why It Matters, and How It's Calculated How Does Bond Yields Affect Stock Market In theory, a rising bond yield should be negative for equity prices because higher. when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market. How Does Bond Yields Affect Stock Market.

From www.youtube.com

Learn about Bonds and Yields with simple examples. How Bond yields How Does Bond Yields Affect Stock Market In theory, a rising bond yield should be negative for equity prices because higher. bond prices and bond yields are always at risk of fluctuating in value, especially in periods of rising or falling interest rates. when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down).. How Does Bond Yields Affect Stock Market.

From exceptionalinsights.group

How Do the Stock and Bond Markets Affect Each Other? Exceptional Insights How Does Bond Yields Affect Stock Market when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. a rally in the stock market tends to raise bond yields as money moves from the relative safer investment bet to riskier. rising bond yields have spooked the equity market as investors tend. How Does Bond Yields Affect Stock Market.

From freeforexcoach.com

How do Bond Yields Affect the Forex Market? How Does Bond Yields Affect Stock Market In theory, a rising bond yield should be negative for equity prices because higher. a rally in the stock market tends to raise bond yields as money moves from the relative safer investment bet to riskier. rising bond yields have spooked the equity market as investors tend to shift away from risky assets. treasury yields don't just. How Does Bond Yields Affect Stock Market.

From www.etnownews.com

Explained What Are Bond Yields And How Do They Affect The Stock How Does Bond Yields Affect Stock Market a rally in the stock market tends to raise bond yields as money moves from the relative safer investment bet to riskier. when a great deal of money leaves stocks and is put into bonds, it often pushes bond prices higher (and yields down). when yields on government bonds rise, they affect everything from the housing market. How Does Bond Yields Affect Stock Market.

From cn.304industrialpark.com

What is Bond Yield and how does it affect the stock market How Does Bond Yields Affect Stock Market treasury yields don't just affect how much the government pays to borrow and how much investors earn by buying government bonds. when yields on government bonds rise, they affect everything from the housing market to student loans, and changes in the treasury market often lead. In theory, a rising bond yield should be negative for equity prices because. How Does Bond Yields Affect Stock Market.